|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Filing Bankruptcy Chapter 7 in PA: A Comprehensive Guide

Understanding Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a legal process designed to help individuals eliminate overwhelming debt. It's often referred to as 'liquidation bankruptcy' because it may involve selling some assets to pay off creditors. In Pennsylvania, as in other states, it provides a fresh financial start for those unable to meet their obligations.

Eligibility Criteria

To qualify for Chapter 7 bankruptcy in PA, you must meet certain criteria. These include passing the means test, which assesses your income against the state's median level. Additionally, you must complete a credit counseling course from an approved provider.

Exemptions in Pennsylvania

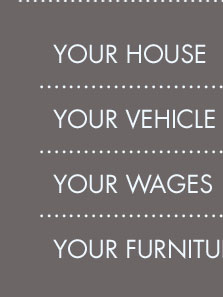

Pennsylvania allows you to choose between state and federal exemptions. These exemptions determine which assets you can protect from liquidation. Common exemptions include:

- Homestead exemption for primary residence

- Motor vehicle exemption

- Personal property exemptions

The Filing Process

Filing for Chapter 7 bankruptcy involves several steps. Here’s a brief overview:

- Gather Financial Documents: Collect information about your income, expenses, assets, and debts.

- Complete Required Forms: Fill out bankruptcy forms with detailed financial information.

- File with the Court: Submit your paperwork to the appropriate bankruptcy court in Pennsylvania.

- Attend the 341 Meeting: A meeting with creditors where they can ask questions about your financial situation.

- Receive a Discharge: If successful, your debts will be discharged, meaning you are no longer legally required to pay them.

It's advisable to consult with an attorney or a legal expert to navigate this complex process. For example, seeking guidance on chapter 7 bankruptcy Indianapolis may offer insights into how local laws can influence proceedings.

Impact and Considerations

Filing for Chapter 7 bankruptcy will significantly impact your credit score and remain on your credit report for up to 10 years. However, it can provide relief from harassing creditor calls and a chance to rebuild your financial stability.

Alternatives to Chapter 7

Before deciding on Chapter 7, consider alternatives such as debt consolidation, negotiation with creditors, or even Chapter 13 bankruptcy, which involves a repayment plan rather than liquidation. You might also explore how similar situations are handled in different jurisdictions, such as chapter 7 bankruptcy New Mexico, to gather a broader perspective.

Frequently Asked Questions

What debts are discharged in Chapter 7 bankruptcy?

Most unsecured debts, such as credit card balances, medical bills, and personal loans, are discharged. However, certain debts like student loans, alimony, and child support are typically not dischargeable.

How long does the Chapter 7 process take?

The process typically takes about four to six months from filing to discharge, assuming no complications arise.

Can I keep my car in a Chapter 7 bankruptcy?

You may keep your car if its value is within the allowed exemption limit and you continue making payments if it's financed.

In conclusion, filing Chapter 7 bankruptcy in Pennsylvania requires careful consideration and preparation. By understanding the process and consulting with professionals, you can make informed decisions to regain financial control.

Between credit cards, two personal loans and a car loan, we have just shy of 62k in debt. Thankfully no tax related items, student loans or ...

Filing Fee: $338.00 Payable By: Attorneys may pay by check; money order; certified bank check; cash or credit card (Visa, Mastercard, American Express or ...

When an individual files Chapter 7, a 341 meeting will be scheduled. The 341 meeting is conducted by a court-appointed trustee who will review your documents ...

![]()